Home> Inspections

Inspections

Why Is The John Deere Home Maintenance Kit So Popular?

By: Isabella Mitchell • Home Maintenance

Why Does My Car Air Conditioning Smell Like Vinegar

By: William Harrison • Home Maintenance

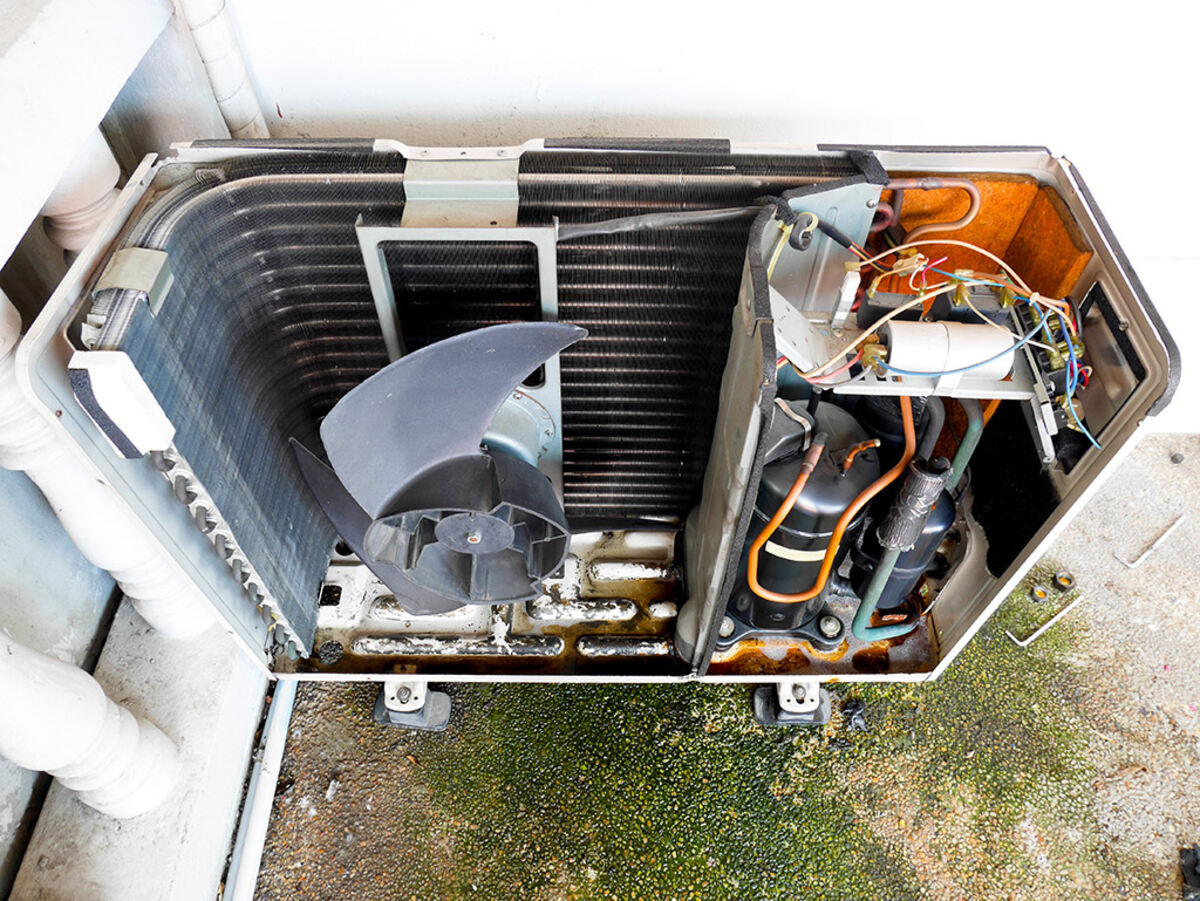

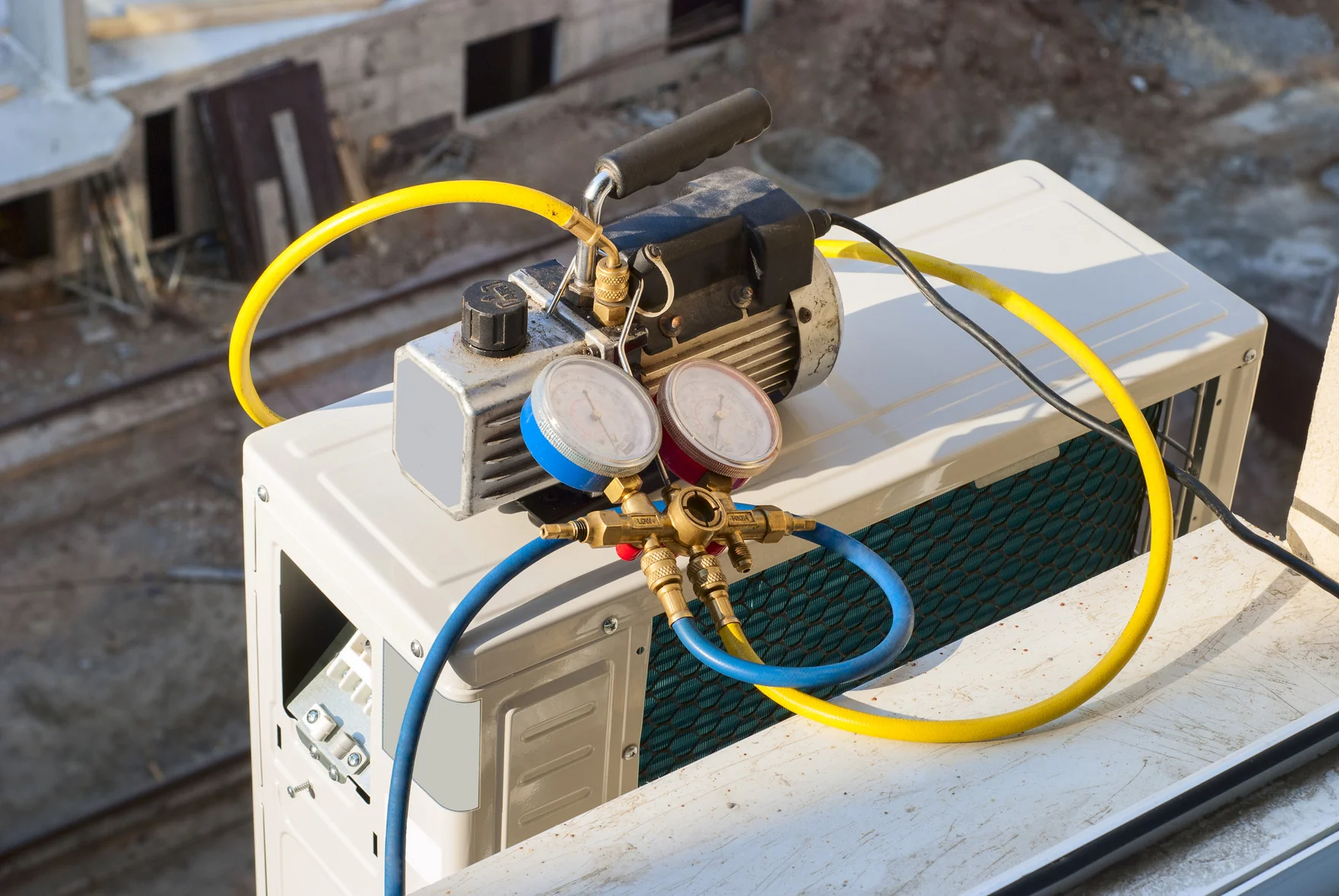

What Takes Heat From The Air And Brings It To The Refrigerant In An Air Conditioning System

By: James Anderson • Home Maintenance